The reservation of gold in central bank 2011

SEEING WASHINGTON'S belligerence over how Beijing pegs the price of its Yuan, three unsettling facts are buried amongst the latest central-bank gold data compiled by the World Gold Council...

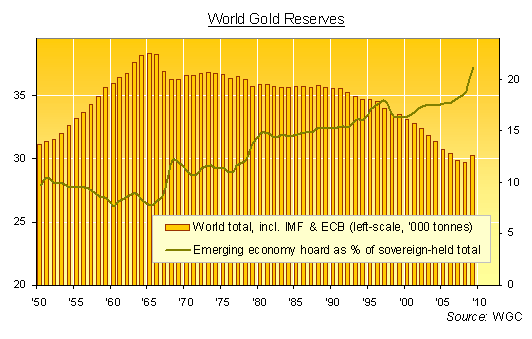

- Central banks worldwide grew their physical gold reserves at the fastest pace since 1965 in 2009, adding bullion for the first time in two decades as a group;

- Emerging economies added a near-record volume of metal to their official reserves, putting more than 21% of all the gold held by sovereign states outside the control of developed-world OECD members;

- Western central banks, in contrast, shrank their reserves by more than 1% last year. Since the end of 2004, they have sold almost twice-as-much gold as non-OECD members have acquired (1881 vs. 994 tonnes).

And now that Congress is threatening trade sanctions against China for under-valuing its currency, the Yuan, Washington might want to take note of how its Dollar came to be the world's No.1 currency.

No comments:

Post a Comment