news2011

Monday, April 18, 2011

Tuesday, October 12, 2010

Mining Firm Closes last big gold 2011

Mining Firm Closes last big gold 2011

Mining Firm Closes last big gold 2011

ANGLOGOLD ASHANTI – the world's fourth-largest Gold Mining company – said today that it's finished closing its "hedge book" of forward sales, buying back gold it had sold ahead of production at an average price of $1300 per ounce.

The New York-listed Gold Mining company says it will now sell all the gold it produces "at market prices", thereby improving cash-flow and profit margins after becoming the last of the world's major miners to retain a sizeable position in forward sales.

"We've moved decisively to eliminate the hedge book," said chief executive officer Mark Cutifani in a press release.

"The completion of the hedge book restructure over the last three years has created about US$4.0 billion of value for our shareholders and represents one of the major building blocks for the new AngloGold Ashanti.

"We remain bullish on the outlook for gold and will now benefit from full exposure to the price as we go forward."

Mining Firm Closes last big gold 2011

ANGLOGOLD ASHANTI – the world's fourth-largest Gold Mining company – said today that it's finished closing its "hedge book" of forward sales, buying back gold it had sold ahead of production at an average price of $1300 per ounce.

The New York-listed Gold Mining company says it will now sell all the gold it produces "at market prices", thereby improving cash-flow and profit margins after becoming the last of the world's major miners to retain a sizeable position in forward sales.

"We've moved decisively to eliminate the hedge book," said chief executive officer Mark Cutifani in a press release.

"The completion of the hedge book restructure over the last three years has created about US$4.0 billion of value for our shareholders and represents one of the major building blocks for the new AngloGold Ashanti.

"We remain bullish on the outlook for gold and will now benefit from full exposure to the price as we go forward."

gold Currencies - 5th October 2010

The UPSHOT from last week's London Bullion Market Association conference in Berlin, writes Adrian Ash of BullionVault, was that there's more sound and fury about bullion in the financial pages than in the dealing rooms right now.

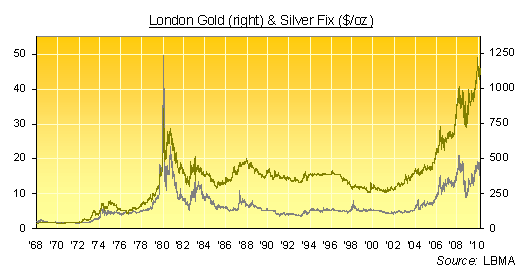

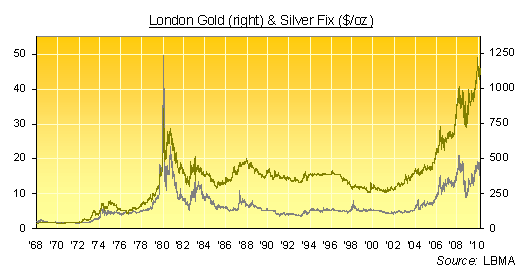

Several dealers I spoke to said business was quiet, if not boring. Gold's current rally, said one speaker, "punches above its weight in terms of significance." Another noted that at the start of September, when Dollar-gold surpassed its June high, volatility was at a 5-year low. (It still is. Silver Price volatility has fallen to a 3-year low as it broke three-decade highs.)

You can see this lack of frenzy in prices alone, in fact – but only if you don't focus on the Dollar alone...

BullionVault's Global Gold Index shows the price of gold against the world's top 10 currencies, weighted by GDP.

Several dealers I spoke to said business was quiet, if not boring. Gold's current rally, said one speaker, "punches above its weight in terms of significance." Another noted that at the start of September, when Dollar-gold surpassed its June high, volatility was at a 5-year low. (It still is. Silver Price volatility has fallen to a 3-year low as it broke three-decade highs.)

You can see this lack of frenzy in prices alone, in fact – but only if you don't focus on the Dollar alone...

BullionVault's Global Gold Index shows the price of gold against the world's top 10 currencies, weighted by GDP.

The reservation of gold in central bank 2011

The reservation of gold in central bank 2011

The reservation of gold in central bank 2011

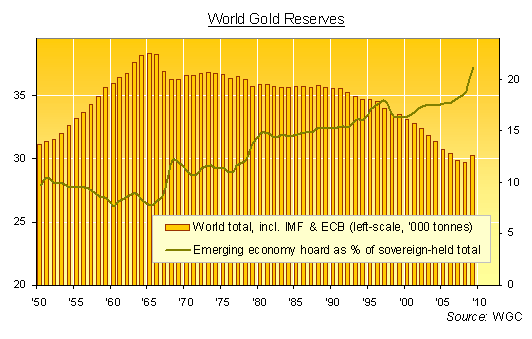

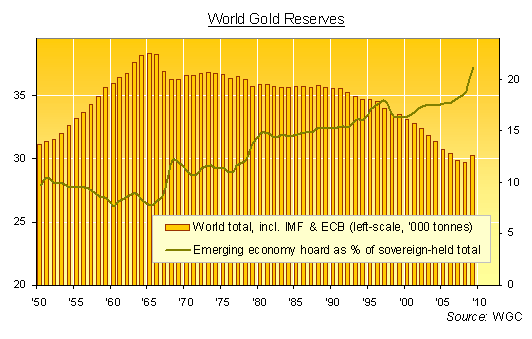

SEEING WASHINGTON'S belligerence over how Beijing pegs the price of its Yuan, three unsettling facts are buried amongst the latest central-bank gold data compiled by the World Gold Council...

And now that Congress is threatening trade sanctions against China for under-valuing its currency, the Yuan, Washington might want to take note of how its Dollar came to be the world's No.1 currency.

The reservation of gold in central bank 2011

SEEING WASHINGTON'S belligerence over how Beijing pegs the price of its Yuan, three unsettling facts are buried amongst the latest central-bank gold data compiled by the World Gold Council...

- Central banks worldwide grew their physical gold reserves at the fastest pace since 1965 in 2009, adding bullion for the first time in two decades as a group;

- Emerging economies added a near-record volume of metal to their official reserves, putting more than 21% of all the gold held by sovereign states outside the control of developed-world OECD members;

- Western central banks, in contrast, shrank their reserves by more than 1% last year. Since the end of 2004, they have sold almost twice-as-much gold as non-OECD members have acquired (1881 vs. 994 tonnes).

And now that Congress is threatening trade sanctions against China for under-valuing its currency, the Yuan, Washington might want to take note of how its Dollar came to be the world's No.1 currency.

The silver's case 2011

CASH-in-the-BANK is the nearest thing to "risk-free" that the finance industry offers. But bank savings now mean "sure-fire loss" thanks to sub-zero real rates of interest.

The longer that interest rates stay below inflation, the more people will be forced to take more risks to defend what money they've got – and one higher-risk choice is Buying Silver. It's slowly becoming ever-more popular, at least amongst that handful of savers and investors who see tomorrow's inflation in today's monetary policy.

The longer that interest rates stay below inflation, the more people will be forced to take more risks to defend what money they've got – and one higher-risk choice is Buying Silver. It's slowly becoming ever-more popular, at least amongst that handful of savers and investors who see tomorrow's inflation in today's monetary policy.

Monday, October 11, 2010

buyer's of gold checklist

#1. Don't take it home, except maybe a few coins

History is littered with sad stories of people who bought gold (rightly) because they feared severe economic contraction in their home country, and then made the mistake of holding their gold at home. When they needed it they could not release its value because it had become contraband.

Think of Zimbabwe (now), Argentina (2001), Yugoslavia (1990s), Vietnam & Cambodia (1970s), Nazi Germany (1930s), the USA (1933), Russia (1917). Gold secures your wealth when it is held in a reliable country. This is unlikely to be your own country if you are wise to be buying gold.

2. Buy 'Good Delivery' fine bullion to save 6-10% over coins & small bars

The world's best gold (assayed at 99.5% or better, and traded 100% 'fine' – i.e. gross bar weight x assayed purity) has a rock-solid perpetual guarantee of its quality and is, surprisingly, also the cheapest. Good Delivery gold also sells for the highest prices. That's because Good Delivery bullion is the spot market standard and is massively more liquid than coin markets.

3. Use allocated storage at a commercial vault – not a bank

Persuading you to hold your gold 'unallocated' lets banks finance their own liquidity reserve with your gold. It is so attractive to banks that they significantly overcharge for the safer 'allocated' storage option. So don't use banks to store gold. Instead, use fully allocated and insured commercial vaults; they don't have a liquidity reserve requirement, and therefore have no motivation to overcharge for allocated.

The wholesale storage rate (including insurance) is about 0.1% per annum in a commercial vault. It will usually be many times that much in a bank. BullionVault charges 0.12% per annum, with a minimum of $4 per month.

4. Direct overseas ownership

Don't get caught out by a trust deed or vault in the wrong jurisdiction. Think about exchange controls. In a world of severe economic contraction, you would almost certainly still be able to travel (if you can afford to buy the ticket), enabling you to physically collect your gold and realize its value outside controls in your home jurisdiction. This is why direct overseas ownership often works better than ownership through a trust. An intermediating trust deed could result in the ownership of gold effectively being trapped in the country where the trust was set up.

History is littered with sad stories of people who bought gold (rightly) because they feared severe economic contraction in their home country, and then made the mistake of holding their gold at home. When they needed it they could not release its value because it had become contraband.

Think of Zimbabwe (now), Argentina (2001), Yugoslavia (1990s), Vietnam & Cambodia (1970s), Nazi Germany (1930s), the USA (1933), Russia (1917). Gold secures your wealth when it is held in a reliable country. This is unlikely to be your own country if you are wise to be buying gold.

2. Buy 'Good Delivery' fine bullion to save 6-10% over coins & small bars

The world's best gold (assayed at 99.5% or better, and traded 100% 'fine' – i.e. gross bar weight x assayed purity) has a rock-solid perpetual guarantee of its quality and is, surprisingly, also the cheapest. Good Delivery gold also sells for the highest prices. That's because Good Delivery bullion is the spot market standard and is massively more liquid than coin markets.

3. Use allocated storage at a commercial vault – not a bank

Persuading you to hold your gold 'unallocated' lets banks finance their own liquidity reserve with your gold. It is so attractive to banks that they significantly overcharge for the safer 'allocated' storage option. So don't use banks to store gold. Instead, use fully allocated and insured commercial vaults; they don't have a liquidity reserve requirement, and therefore have no motivation to overcharge for allocated.

The wholesale storage rate (including insurance) is about 0.1% per annum in a commercial vault. It will usually be many times that much in a bank. BullionVault charges 0.12% per annum, with a minimum of $4 per month.

4. Direct overseas ownership

Don't get caught out by a trust deed or vault in the wrong jurisdiction. Think about exchange controls. In a world of severe economic contraction, you would almost certainly still be able to travel (if you can afford to buy the ticket), enabling you to physically collect your gold and realize its value outside controls in your home jurisdiction. This is why direct overseas ownership often works better than ownership through a trust. An intermediating trust deed could result in the ownership of gold effectively being trapped in the country where the trust was set up.

forex : prices of gold 2011

World stock markets were little changed, with both Tokyo and Toronto closed for national holidays.

German and UK bonds slipped back, nudging interest rates higher. The US bond market stayed shut for Columbus Day.

That correlation would read +1.0 if gold and the Euro moved perfectly in lock-step, or minus 1.0 if they were perfectly opposed.

Gold Prices had diverged dramatically from the Euro during this spring's Greek deficit crisis, with the correlation sinking to –0.92 in May as both gold and the Dollar leapt vs. the single European currency.

Over the last 10 years, daily gold and Euro prices have displayed a strong, positive correlation of +0.50 vs. the Dollar.

German and UK bonds slipped back, nudging interest rates higher. The US bond market stayed shut for Columbus Day.

That correlation would read +1.0 if gold and the Euro moved perfectly in lock-step, or minus 1.0 if they were perfectly opposed.

Gold Prices had diverged dramatically from the Euro during this spring's Greek deficit crisis, with the correlation sinking to –0.92 in May as both gold and the Dollar leapt vs. the single European currency.

Over the last 10 years, daily gold and Euro prices have displayed a strong, positive correlation of +0.50 vs. the Dollar.

Subscribe to:

Posts (Atom)